Difference between revisions of "Accrual Maximums Configuration"

m |

m |

||

| Line 5: | Line 5: | ||

To have the employees lose all hours at the end of the year, since the end of the year may be in the middle of an accrual period, that period will either belong to the old year or the new year. | To have the employees lose all hours at the end of the year, since the end of the year may be in the middle of an accrual period, that period will either belong to the old year or the new year. | ||

| − | To consider the whole period as last year: Amount Type should be set to "Maximum Hours" and the Date should be set to 12/31/ | + | To consider the whole period as last year: "Max. Type" should be set to "Recurring Date Based Balance". "Max. Amount Type" should be set to "Maximum Hours" and the Date should be set to 12/31/2001. |

| − | To consider the whole period as the new year: Amount Type should be set to "Calendar Year" and the Date should be set to 1/1/ | + | To consider the whole period as the new year: "Max. Type" should be set to "Recurring Date Based Balance". Max. Amount Type should be set to "Calendar Year" and the Date should be set to 1/1/2001. |

There is no option to split in the middle of a period and have one part lost and the other earning since the accruals are all earned in chunks at the end of the accrual period. The only way to split would be to adjust the actual dates of the last/first Actual period and make it a little shorter/longer so that it matches the end/start of the year. | There is no option to split in the middle of a period and have one part lost and the other earning since the accruals are all earned in chunks at the end of the accrual period. The only way to split would be to adjust the actual dates of the last/first Actual period and make it a little shorter/longer so that it matches the end/start of the year. | ||

Revision as of 19:43, 8 February 2018

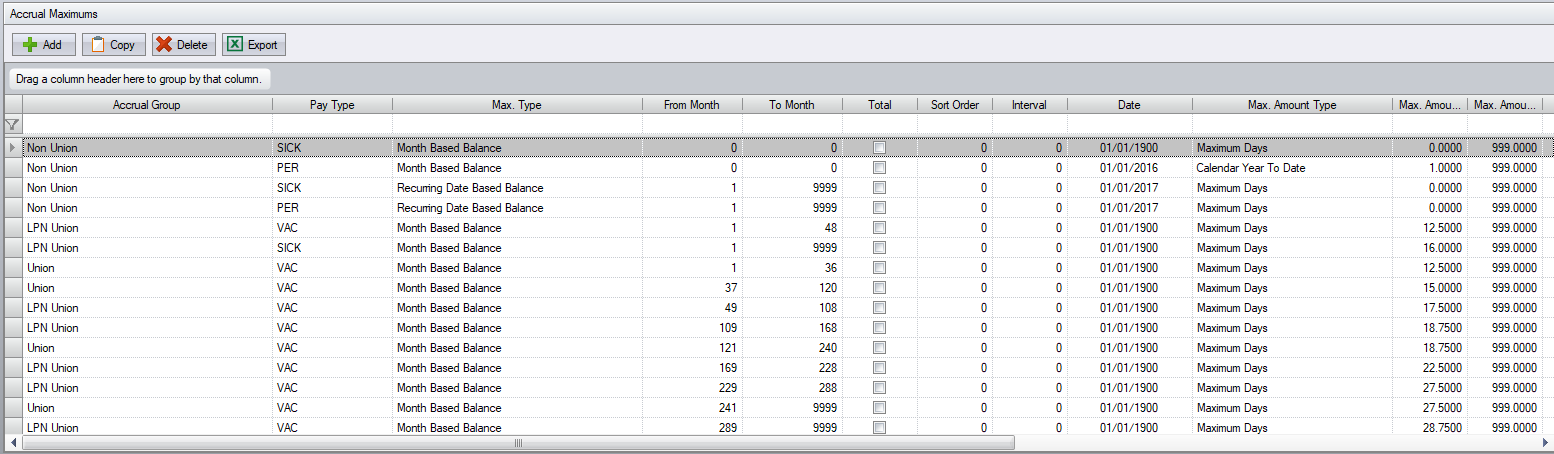

| This topic is for advanced users |

To have the employees lose all hours at the end of the year, since the end of the year may be in the middle of an accrual period, that period will either belong to the old year or the new year.

To consider the whole period as last year: "Max. Type" should be set to "Recurring Date Based Balance". "Max. Amount Type" should be set to "Maximum Hours" and the Date should be set to 12/31/2001.

To consider the whole period as the new year: "Max. Type" should be set to "Recurring Date Based Balance". Max. Amount Type should be set to "Calendar Year" and the Date should be set to 1/1/2001.

There is no option to split in the middle of a period and have one part lost and the other earning since the accruals are all earned in chunks at the end of the accrual period. The only way to split would be to adjust the actual dates of the last/first Actual period and make it a little shorter/longer so that it matches the end/start of the year.