PBJ Export

Contents

Overview

The Payroll Based Journal is a system for facilities to submit staffing and census information to the Centers for Medicare and Medicaid Services (CMS). CMS started collecting staffing and census data through the PBJ system on a voluntary basis on October 1, 2015, and will collect it on a mandatory basis beginning on July 1, 2016.

CMS provides a website where the data is submitted. The data can be manually entered, and/or imported from a file. The SBV software can create the file from the time card data so as to eliminate the manual entry system. The PBJ file is essentially a payroll export. It is similar to the file that you create for exporting the employee's hours data to your payroll system. Similar to a payroll file, the PBJ file has to be created to the correct specifications and there have to be mappings between the data in the SBV software and the data that is included in the PBJ file. The instructions below show you how to specify all the required mappings between SBV and PBJ so that once the mappings are completed, you can create the file ready for submission to PBJ.

For information on PBJ, please refer to the following websites:

- Centers for Medicare and Medicaid Services PBJ Home Page.

- QTSO e-University Online Training

- To get access to the PBJ system

PBJ Module

To see if your software has the PBJ module, go to the Help tab and click on About and look for PBJ in the list of modules. At the same time you can also note your software version. Your software version will display in the format such as 3.5.6001.12345. Note the third number (6001). As SBV is adding features to accommodate changes made by CMS and is adding features to handle different scenarios that arise with client's data, certain features below may not be in your version. When a new feature is added we will tell you from what version this feature has been added, e.g. this feature was added with version 6001.

Requirements

In order to submit the data in the Time and Attendance software to CMS using the SBV software you need to know the following:

- Your PBJ Facility ID and the state the facility is in

- The employees that you will submit as exempt

- The companies that contain employees that you pay directly (payroll) as opposed to agency or 1099 contractors that are considered contracted staff, or alternatively, the departments that contain the contract staff

- The PBJ Job Title Code for each employee

- The pay types that you consider are worked hours for PBJ purposes

The data required by CMS is organized into 4 sections; header, employees, hours and census. Within each section, the Time and Attendance software requires you to provide the necessary CMS/PBJ mapping information so that we can convert the Time and Attendance data into CMS/PBJ compliant data. The items that you must complete are indicated below as Required.

Header

The header contains information to identify your facility and the state that your facility is in.

Required: You need to enter your PBJ facility identifier and state into the software. For a single facility software the PBJ Facility ID is entered in Configuration / Setup / System / Payroll. The state is entered in Configuration / Setup / System / Defaults. In a multi-facility software both the PBJ Facility ID and the state are entered in Configuration / Setup / Labor Levels / Facility in the Optional tab.

Employees

Employee information that PBJ requires are hire and termination dates, and whether you consider the employee to be exempt, non-exempt or contract.

Hire and Termination Dates

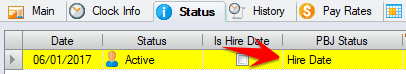

The PBJ Status Type column in the Employee / Status tab gives you complete control over the Hire Dates and Termination Dates submitted to PBJ. If an active date is not a hire date but a return to active status after a medical or long term leave, you can tell the software to ignore this status for PBJ.

Hire dates are required for all staff. There are 2 methods that the software will use to determine the Hire Date:

- The latest employee status (Employee / Status tab) with the PBJ Status Type of Hire Date.

- The first day that the employee worked and has hours.

Note: There is the requirement that a rehired employee that has had a termination date previously submitted to PBJ can only be submitted with a hire date that is later than the previously submitted termination date. If an employees has a PBJ Status Type of Hire Date after a PBJ Status Type of Termination Date then we will include only the PBJ Hire Date in the file. We will also not assume any Termination date because no punch or hours information exists. As such, unless the employee has a PBJ Status Type entry of Termination Date in their Status tab, we will assume that they are still currently active.

Exempt, Non-Exempt, Contract

PBJ requires what they are calling a Pay Type Code which is used to distinguish Exempt, Non-Exempt and Contract staff. For PBJ purposes, Exempt is what you usually refer to as Salaried in payroll. It does not mean that you want to exclude this employee from PBJ. Contract means any staff that you do not pay directly, e.g. from a nursing agency.

If you have a company labor level, then the Is In House setting on each company will distinguish contract staff from your payroll employees. If you do not have a Company labor level then as of version 6008, there is a setting on the Department labor level named Is Contract.

Required: In Configuration / Setup / Labor Levels / Company, in the Optional tab, select Is In House for your payroll companies. If you do not have a company labor level then you will need to use the Department labor level by using the Is Contract setting. In Configuration / Setup / Labor Levels / Department, in the Optional tab, select Is Contract for your contract departments.

To distinguish your exempt (salaried) from your non-exempt (hourly) staff we are providing three levels at which you can do this; at the pay rule level, at the base schedule group level, and at the employee level.

Required: Determine at what level you wish to identify your exempt staff. This can be done by using the Is PBJ Exempt setting in either the pay rule (Configuration / Calculation / Pay Rules / Misc tab), the base schedule group (Configuration / Schedules / Base Schedules), or on a per employee basis on the Employee / Misc tab. For example, if you have a pay rule that is used with Salaried staff then by using the Is PBJ Exempt setting on this pay rule, all employees using this pay rule will be identified as exempt.

Hours

Only the employee's paid hours for time worked are to be submitted. You should not submit hours that were worked and were not paid, nor submit hours that were paid and were not worked. This has been clearly stated in the first revision of the PBJ guidelines with an example given: A salaried employees working 10 hours but getting paid 8 hours must be submitted as 8 hours.

Note: Agency and contract staff need to be included in this report so therefore at the very least be entered in the software and have their hours per day entered.

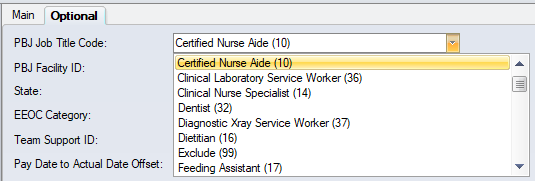

Required: Specify the labor level that will be used to identify the PBJ Job Title Code for each employee and their hours. This is done is Configuration / Setup / Labor Level Designations. The setting is named PBJ Labor Level. The default is the department level which means that all employees and their hours in each department must be considered to be in the same PBJ Job Title Code. If the department level will not provide the correct PBJ Job Title Code then you will need to add a new labor level (Configuration / Setup / System / Labor Levels tab). You will then have full control over each individual employee's PBJ Job Title Code including the ability to change the PBJ Job Title Code on hours without requiring you to change the employee's department. SBV has a import ready to populate your PBJ labor level with the PBJ Job Title Codes.

Required: Specify the PBJ Job Title Code for each labor level item including a choice of Exclude From Report for labor levels that are not considered to be direct care. This is done is Configuration / Setup / Labor Levels / Department (or whatever labor level you specified as being your PBJ labor level) in the Optional tab (as of version 6006).

Required: Select the pay types that are considered worked making sure not to include matching pay types such as differentials. This is done in Configuration / Schedules / Pay Types in the Rates and Payroll tab. The setting is named Is PBJ Pay Type.

Note: The following hours are included in the file:

- All time calculated from punches that occurs between midnight to midnight from the the start date at 12:00am until the end date at 11:59pm.

- All hours not from punches with an actual date between the start date and end date. Example of these hours may be owed time or salaried non punching employees.

- The maximum number of hours that can be submitted in a single date is 24 so if you are entering salaried or owed time on one date, it cannot exceed 24 hours.

Census

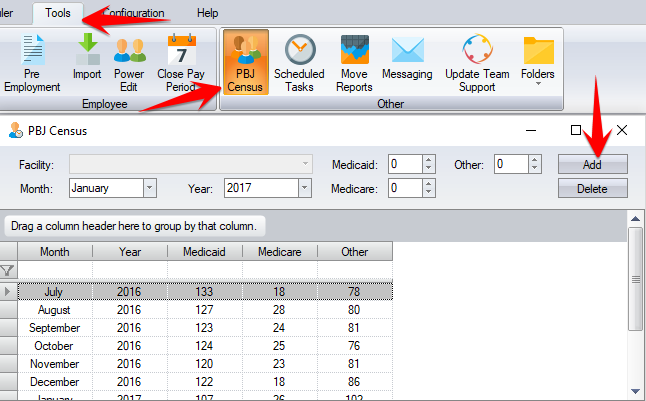

The census can be included in the PBJ file or can be manually entered on the PBJ website after submitting the file.

For each month of the PBJ report there are 3 census numbers; Medicaid, Medicare and Other.

Note: the PBJ monthly census is entered from Tools / PBJ Census. The census should be based on the last day of the month, and needs to be split between Medicaid, Medicare and Other. The census does not have to be submitted in the file and can be entered manually on the PBJ website.

Creating the File

The Time and Attendance software creates the ZIP file(s) as required by CMS. Each ZIP file contains a single XML file. If your software contains a single facility then the zip file will be named pbj.zip and the xml file in the zip file will be named pbj.xml. In a multi-facility software, the zip and xml file will both be named using the facility description.

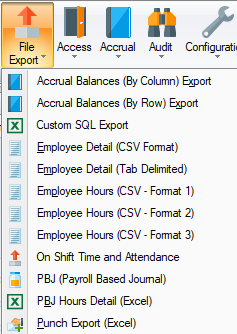

The PBJ Export is run from Reports / File Export / PBJ (Payroll Based Journal). We recommend version 6020 or later in order to submit files on or after 6/27/2016 due to enhancements in handling hours thru midnight when employees have both punched time and other hours added or deducted. If you want to submit the July to September quarter in partial files then you need version 6075 where merge is now the default submission method (merge allows you to submit the quarter in multiple files).

Note: You can only include data from the same fiscal quarter in the file. The minimum date range is one day and the maximum date range is the three calendar months from the same fiscal quarter.

Important: When running the PBJ Export do NOT exclude any employees except in a multi-facility setup when you want to run the export for just a single facility. As such, do NOT filter any employees and be sure to include all statuses under Current Status.

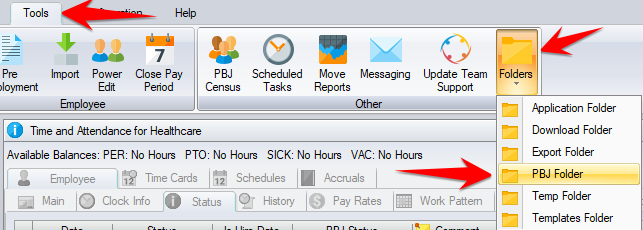

After you run the export, the folder where the PBJ files are created will open automatically. In case you close this folder, you can access it from Tools / Folders / PBJ Folder.

The same data that is placed into the PBJ file can be viewed in Excel format by running the PBJ Hours Detail (Excel) report also from the Reports / File Export menu (added in version 6024).

Important: The software will create a log file in the PBJ folder that will point out any issues with the PBJ file that have been handled but may indicate that some of your information is incorrect or is missing from the PBJ file. For example, if you have hours after a termination date. The file is named pbj.log in a single facility software and in a multi-facility software it will be named after the facility.

Frequently Asked Questions

Question: Do you know my PBJ Facility ID or can you get it for me?

Answer: SBV has no access to the PBJ system so you need to get your PBJ Facility ID directly from CMS directly. Here is a link to get access to the PBJ system

Question: Does the SBV software submit the PBJ file?

Answer: No, our software creates the file but you submit the file to the CMS system. Our software does not "talk" directly to the CMS system.

Question: Should this employee, department or pay type be included in the submission to PBJ?

Answer: SBV cannot advise you on what information should be submitted to PBJ. CMS states "reporting should be based on the employee’s primary role and their official categorical title. It is understood that most roles have a variety of non-primary duties that are conducted throughout the day (e.g., helping out others when needed). Facilities should still report just the total (worked) hours of that employee based on their primary role."

Question: Is this position (i.e. DNS, ADNS, RN Office, Dietary) considered "direct care"?

Answer: CMS provides a list of PBJ Job Title Codes and you can assign a Job Title Code to any department that matches to one of these Job Title Codes. Job Title Codes that CMS considers are not direct care can be selected and CMS will ignore this data, e.g. Housekeeping. Some departments such as Food Service Workers do not have a corresponding Job Title Code to choose which infers that Food Service Workers are not considered direct care.

Question: How does CMS define "direct care"?

Answer: CMS defines direct care as "direct care staff are those individuals who, through interpersonal contact with residents or resident care management, provide care and services to allow residents to attain or maintain the highest practicable physical, mental, and psychosocial well-being. Direct care staff does not include individuals whose primary duty is maintaining the physical environment of the long term care facility (for example, housekeeping)."

Question: I do not understand something in the PBJ documentation provided by CMS. Can SBV explain it to me?

Answer: SBV is not providing PBJ consulting services. We are creating the PBJ file subject to our interpretation of the PBJ file specifications, but are not providing guidance on the employees and the hours that you choose to submit to PBJ.

Question: If I have the PBJ module, does this mean that I have the license to the PBJ module?

Answer: SBV is providing access to the PBJ module to all clients in good financial standing without requiring the PBJ license for the duration of 2016. Clients can then can decide if the SBV software is what they wish to use for PBJ submissions or if they want to use a third party solution instead. SBV will offer clients the choice to license the PBJ module in 2017.